Merchants expect sales people to understand the payments business and how their solutions can help them. Knowledge means power and confidence in the selling process so it makes sense to have that knowledge in order to make more, better sales.

Here is a handy list of terms used in payment processing. Keep checking back for regular updates as the payments ecosystem evolves. And if you want new terms added, just let me know!

Acceptance:

The process whereby a particular brand of card is accepted by a terminal, merchant or other entity.

Acquirer (card acquirer):

The entity (usually a credit institution) to which the acceptor (usually a merchant) transmits the information necessary in order to process the card payment.

In automated teller machine (ATM) transactions, the entity (usually a credit institution) which makes banknotes available to the cardholder (whether directly or via the use of third-party providers).

Authentication:

A security mechanism for verifying: 1) the identity of an individual or other entity (including verification by means of a computer or computer application); and 2) the level of authority of that person or entity (i.e. the ability of that person or entity to perform specific tasks or activities).

Automated teller machine (ATM):

an electromechanical device that allows authorised users, typically using machine-readable plastic cards, to withdraw cash from their accounts and/or access other services (allowing them, for example, to make balance enquiries, transfer funds or deposit money).

Backup system:

A system designed to replace the primary system in the event of the primary system being unable to function for whatever reason.

Bank Identifier Code (BIC):

An International Organization for Standardization (ISO) technical code that uniquely identifies a financial institution. SWIFT is the registration authority for BICs. A BIC consists of eight or eleven characters, comprising a financial institution code (four characters), a country code (two characters), a location code (two characters) and, optionally, a branch code (three characters).

Batch (bulk payments):

A group of orders (payment orders and/or securities transfer orders) to be processed together.

Beneficiary:

A recipient of funds (payee) or securities. Depending on the context, a beneficiary can be a direct participant in a payment system and/or a final recipient.

Brand:

A particular payment product (especially a card) that has been licensed by its owner for use in a given territory.

Business continuity:

A state of uninterrupted business operations. This term also refers to all of the organisational, technical and staffing measures employed in order to:

1) ensure the continuation of core business activities in the immediate aftermath of a crisis; and

2) gradually ensure the continued operation of all business activities in the event of sustained and severe disruption. See also backup system.

Cap (limit):

A quantitative limit on the funds or securities transfer activity of a participant in a system. Limits may be set by each individual participant or imposed by the entity managing the system. Limits can be placed on system participants’ net debit and/or net credit positions.

Card (payment card):

A device that can be used by its holder to pay for goods and services or to withdraw money.

Card acquirer:

See acquirer.

Cardholder:

A person to whom a payment card is issued and who is authorised to use that card.

Cardholder Verification Value (CVV2, CVC2 and CID)

A method of cardholder verification uses the Card Verification Value (CVV). The generic system name is labelled Card Verification Value 2 (CVV2) by Visa, Card Validation Code 2 (CVC2) by MasterCard and Cardholder Identification Code (CID) by American Express. Card Verification information is not contained in the magnetic stripe information nor does it appear on sales receipts. It is an additional 3 to 4 character value, printed on the front or back of Visa, MasterCard, and American Express cards. To use Card Verification, enter the 3 to 4 character value along with the other transactional information at the time of processing the transaction. If the 3 to 4 character value is not authenticated by the cardholder’s bank, the transaction will be declined. If the 3 to 4 character value is authenticated, the transaction will be processed normally.

Card issuer:

A financial institution that makes payment cards available to cardholders, authorises transactions at point-of-sale (POS) terminals or automated teller machines (ATMs) and guarantees payment to the acquirer for transactions that are in conformity with the rules of the relevant scheme.

Card Present:

A payment transaction where both cardholder and card are present. For instance in a retail shop.

Card Not Present:

A payment transaction where cardholder and card are not present. For instance web purchase or phone order.

Chargeback:

Process where a cardholder is asking the bank to forcibly take money from the merchant’s account. An investigation follows, and if the bank feels the cardholder’s request is valid, funds are removed from the merchant’s account and returned to the consumer.

Card scheme:

A technical and commercial arrangement set up to serve one or more brands of card which provides the organisational, legal and operational framework necessary for the functioning of the services marketed by those brands. See also three-party card scheme, four-party card scheme.

Card with a cash function:

A card enabling the cardholder to withdraw cash from a cash dispenser and/or deposit cash. The cash function is usually combined with a payment function. See also cash card.

Cash card:

A card which has only a cash function.

Cash dispenser:

An electromechanical device that permits authorised users to withdraw banknotes, typically using machine-readable plastic cards. See also automated teller machine.

Charge card:

See delayed debit card.

Cheque:

A written order from one party (the drawer) to another (the drawee; normally a credit institution) requiring the drawee to pay a specified sum on demand to the drawer or a third party specified by the drawer.

Chip card (smart card):

A card with an embedded microprocessor (chip) loaded with the information necessary to enable payment transactions.

Clearing:

The process of transmitting, reconciling and, in some cases, confirming transfer orders prior to settlement, potentially including the netting of orders and the establishment of final positions for settlement. Sometimes this term is also used (imprecisely) to cover settlement.

Clearing house:

A common entity (or a common processing mechanism) through which participants agree to exchange transfer instructions for funds, securities or other instruments. In some cases, a clearing house may act as a central counterparty for those participants, thereby taking on significant financial risks.

Clearing system:

A set of rules and procedures whereby financial institutions present and exchange data and/or documents relating to transfers of funds or securities to other financial institutions at a single location (e.g. a clearing house). These procedures often include a mechanism for calculating participants’ mutual positions, potentially on a net basis, with a view to facilitating the settlement of their obligations in a settlement system.

Co-branding:

An arrangement whereby a product or service is associated with more than one brand.

Collateral:

An asset or third-party commitment that is used by a collateral provider to secure an obligation vis-à-vis a collateral taker.

Correspondent banking:

An arrangement whereby one bank (the settlement or service-providing bank) makes or receives payments (potentially performing other banking services in addition) on behalf of another bank (the customer or user bank).

Credit card (card with a credit function):

A card that enables cardholders to make purchases and/or withdraw cash up to a prearranged credit limit. The credit granted may be either settled in full by the end of a specified period, or settled in part, with the balance taken as extended credit (on which interest is usually charged).

Credit institution:

A credit institution is a company duly authorised to carry out banking transactions on a regular basis (i.e. to receive deposits from the public, carry out credit transactions, make funds available and manage means of payment).

Credit limit (credit cap):

A limit on the credit exposure which a payment system participant incurs either vis-à-vis another participant (a “bilateral credit limit”) or vis-à-vis all other participants (a “multilateral credit limit”) as a result of receiving payments which have not yet been settled.

Credit risk:

The risk that a counterparty will not settle the full value of an obligation – neither when it becomes due, nor at any time thereafter. Credit risk includes replacement cost risk and principal risk. It also includes the risk of the settlement bank failing.

Cross-border payment:

A payment where the financial institutions of the payer and the payee are located in different countries.

Cross-border settlement:

Settlement that takes place in a country (or currency area) in which one or both parties to the transaction are not located.

Cut-off time:

The deadline set by a system (or an agent bank) for the acceptance of transfer orders for a given settlement cycle.

Daily processing:

The complete cycle of processing tasks which need to be completed in a typical business day, from start-of-day procedures to end-of-day procedures. This sometimes includes the backing-up of data.

Debit card (card with a debit function):

A card enabling its holders to make purchases and/or withdraw cash and have these transactions directly and immediately charged to their accounts, whether these are held with the card issuer or not.

Direct debit:

A payment instrument for the debiting of a payer’s payment account whereby

EFTPOS terminal:

A terminal which captures payment information by electronic means and transmits such information either online or offline. “EFTPOS” stands for “electronic funds transfer at point of sale”. See also point-of-sale (POS) terminal.

Electronic money:

a monetary value, represented by a claim on the issuer, which is:

1) stored on an electronic device (e.g. a card or computer);

2) issued upon receipt of funds in an amount not less in value than the monetary value

received; and

3) accepted as a means of payment by undertakings other than the issuer.

Electronic money institution (ELMI):

A term used in EU legislation to designate credit institutions

which are governed by a simplified regulatory regime because their activity is limited to the issuance of electronic money and the provision of financial and non-financial services closely related to the issuance of electronic money.

Electronic wallet/purse:

see multi-purpose prepaid card.

Electronic signature (digital signature):

a string of data, generated by a cryptographic method, which is attached to an electronic message in order to guarantee its authenticity, identify the

signatory and link the content to that signatory (thereby protecting the recipient against repudiation

by the sender).

ELMI:

See electronic money institution.

EMV:

an acronym describing the set of specifications developed by the consortium EMVCo, which

is promoting the global standardisation of electronic financial transactions – in particular the global interoperability of chip cards. “EMV” stands for “Europay, MasterCard and Visa”.

Exposure:

the loss that would be incurred if a certain risk materialised.

Face-to-face payment:

A payment where the payer and the payee are in the same physical

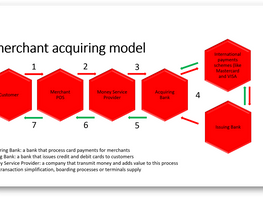

Four-party card scheme:

a card scheme where the stakeholders involved are:

1) the issuer; 2) the acquirer; 3) the cardholder; and 4) the card acceptor. (In the case of automated teller machine (ATM) transactions, it is usually the acquirer that offers its services via the ATM.) By contrast, in a three-party card scheme, the issuer and the acquirer are always the same entity.

Gross settlement:

The settlement of transfer orders one by one.

See also net settlement.

Guarantee fund:

A fund which compensates non-defaulting participants for losses which they suffer in the event that one or more participants default on their obligations.

Interchange fee:

A transaction fee payable between the payment service providers involved in a transaction.

Merchant Account:

A merchant business will need a merchant account in order to accept payments. A merchant account is similar to any bank account. The type of account will depend on the device and method by which the merchant accepts card data.

Merchant service charge (MSC):

A fee paid by the acceptor/merchant to the acquirer.

Merchant account statement:

A monthly merchant account statement tells how much card transactions have been accepted, what kind of cards and how much the merchant acquirer is charging for each transaction.

Merchant Category Code

Banks assign a merchant category code to describe types of business activity. It helps to assess potential risks.

Mobile payment (m-payment):

A payment where a mobile device is used at least for the initiation of the payment order and potentially also for the transfer of funds.

MSC:

See merchant service charge.

Multi-purpose prepaid card (electronic purse/wallet):

a prepaid card which can be used at the outlets of several service providers for a wide range of purposes.

Net settlement:

The settlement of transfer orders on a net basis. See also gross settlement.

Offline card transaction:

A card transaction which is authorised without contacting the issuer at the time of the transaction.

Online card transaction:

A card transaction which is authorised following explicit approval by the issuer at the time of the transaction.

Payment Gateway

This is an online equivalent of a card terminal as its job is to mediate communications between merchants and banks.

Payment gateways securely transmit sensitive card information and debits the customer’s account for the required amount.

Much like a physical POS terminal in a shop, the Payment Gateway allows you to take card payments directly from your website either by integrating a secure payments page or directly customers to a secure external payment gateway.

Payment card:

see card.

Payment instrument:

A tool or a set of procedures enabling the transfer of funds from a payer to a

payee. The payer and the payee can be one and the same person.

Payment scheme:

A set of interbank rules, practices and standards necessary for the functioning of payment services. See also card scheme.

PIN:

See personal identification number.

PCI DSS:

The PCI DSS (Payment Card Industry Data Security Standard) is an information security standard designed to increase controls around cardholder data to reduce payment card fraud. Merchants, providers and any institution that stores or transmits cardholder data have to meet these standards.

Point-of-sale (POS) terminal:

A device allowing the use of payment cards at a physical (not virtual) point of sale. The payment information is captured either manually on paper vouchers or by electronic means. See also EFTPOS terminal.

PDQ Machine / Card reader terminal

A PDQ machine (or Process Data Quickly Machine) is a physical device (card machine with chip and pin keypad) used to process card payments and the card payment software that manages orders (also referred to as a point of sale system).

PDQ machines come in three forms:

- Countertop: A fixed card payment terminal usually located at the point of sale in a retail environment. Needs to be connected to broadband by an Ethernet cable. Can accept contactless payments.

- Portable: These terminals use wireless or Bluetooth technology to operate within a 100m radius of a central hub. Ideal for start-ups, pop-ups and businesses with no fixed address. Will need to be charged to ensure payments can be taken. Can accept contactless payments.

- Mobile: Uses a mobile sim and GPS signals to accept payments anytime, anywhere. Perfect for festivals or large, busy events, as well as for restaurants and cafes where the terminal can be bought to a customer’s table.

Prepaid card:

A card on which a monetary value can be loaded in advance and stored either on the card itself or on a dedicated account on a computer. Those funds can then be used by the holder to make purchases. See also multi-purpose prepaid card.

Processing:

The performance of all of the actions required in accordance with the rules of a system for the handling of a transfer order from the point of acceptance by the system to the point of discharge from the system. Processing may include clearing, sorting, netting, matching and/or settlement.

Refund:

In card payment this is the process where a card holder requests a refund to their card because the goods/services bought did not meet their expectations. Goods could have been faulty or wrong specification. Also see chargeback.

Reject:

In the field of payments, a payment transaction whose normal execution is prevented by the payment service provider of either the payer or the payee prior to settlement.

Retailer card:

A card issued by a merchant for use at specified merchant outlets.

SEPA:

See Single Euro Payments Area.

Settlement:

The completion of a transaction or of processing with the aim of discharging participants’ obligations through the transfer of funds and/or securities. Also see gross settlement, net settlement.

Settlement day (settlement date):

The day on which settlement actually takes place.

Single Euro Payments Area (SEPA):

A process initiated by European banks and supported, interalia, by the Eurosystem and the European Commission with a view to integrating retail payment systems and transforming the euro area into a true domestic market for the payment industry.

Three-party card scheme:

A card scheme involving the following stakeholders: 1) the card scheme itself, which acts as issuer and acquirer; 2) the cardholder; and 3) the accepting party. This contrasts with a four-party card scheme, where the issuer and the acquirer are separate entities and are separate from the card scheme itself. See also card scheme, four-party card scheme.

Truncation:

A procedure in which a paper-based transfer order or other financial instrument is replaced, in whole or in part, by an electronic record of the content of that instrument for the purposes of further processing and transmission.

Find out how my sales coaching and merchant services sales training can help you make more sales